ReConnect Africa is a unique website and online magazine for the African professional in the Diaspora. Packed with

essential information about careers, business and jobs, ReConnect Africa keeps you connected to the best of Africa.

ReConnect Africa is a unique website and online magazine for the African professional in the Diaspora. Packed with

essential information about careers, business and jobs, ReConnect Africa keeps you connected to the best of Africa.

Tracking Market Progress – Frank Senyor Dewotor of Databank Group gives his half year review of African stock markets

The African continent continued its spectacular bullish trend in the second quarter of 2004, with African stock markets firmly perched at the upper echelons of global performance rankings at the close of the half year.

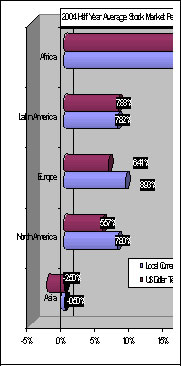

In the half-year, index returns in Africa outside Zimbabwe averaged 19.21% in US dollar terms and 19.26% in local currency terms. This compares favourably to an average index return in US dollar terms of 7.88% in Latin America, 6.41% in Europe, 5.57% in North America,-2.5% in Asia and a global average of 7.91%. Out of the top ten best performing markets in the world during the period, six (6) were from Africa, two (2) from Latin America and two (2) from Europe.

In the half-year, index returns in Africa outside Zimbabwe averaged 19.21% in US dollar terms and 19.26% in local currency terms. This compares favourably to an average index return in US dollar terms of 7.88% in Latin America, 6.41% in Europe, 5.57% in North America,-2.5% in Asia and a global average of 7.91%. Out of the top ten best performing markets in the world during the period, six (6) were from Africa, two (2) from Latin America and two (2) from Europe.

Ghana which topped the world performance rankings last year remained in the number one spot at the end of the half year driven by strong corporate results, declining inflation, falling interest rates and an overall improvement in the macroeconomic environment. Index returns reached 92% in US dollar terms in Ghana in the half year and 96% in local currency terms. The stellar performance of the market over the past 3 years has made IPO capital very cheap and this has elicited interest from companies to list on the Ghana bourse. At least five companies are slated to list on the Ghana bourse with a current market capitalization of $11bn in the second half of the year.

The Uganda bourse which is one of the smallest markets on the continent, consolidated last year’s strong showing with index (composite) returns reaching 58% in dollar terms and 46% in local currency terms

on the wings of a strong local currency, declining interest rates and a favourable inflation outlook.

High crude oil prices, increased OPEC quota for Nigeria, higher oil output in the half-year and programmed deregulation of the oil industry have boosted Nigeria’s economic outlook, although corruption remains a concern. Strong corporate results for several listed companies, the naira’s stability and some degree of speculation are also contributors to the strong returns in Nigeria this year. In the half year, index returns in Nigeria reached 44% in both Naira and US dollar terms.

Broadly, the outlook for the markets in Africa for the rest of this year is highly dependent on crude oil prices, the strength of the dollar and the overall outlook for the global economy. The strong global economic outlook could, however, ensure that the prices for several of Africa’s commodity exports (especially precious minerals) remain bullish in the short to medium term.

Databank Group (www.databankgroup.com)