Kenya – Investing in Art

East Africa's art market lags behind its neighbours in West and South Africa. But some punchy corporate support, driven by people like Safaricom's Michael Joseph and CBA's Isaac Awuondo, could draw more attention to the fact that it could be an interesting investment proposition, says Rachel Keeler.

East Africa's art market lags behind its neighbours in West and South Africa. But some punchy corporate support, driven by people like Safaricom's Michael Joseph and CBA's Isaac Awuondo, could draw more attention to the fact that it could be an interesting investment proposition, says Rachel Keeler.

Kenya's burgeoning upper middle class has brought a lot of visible change to Nairobi in the past decade. A city that under former President Moi was best known for menacing vagrants and trash heaps the size of football fields is now relatively clean and refreshingly modern. Young professionals with cash to spare crowd out urban chic cafes and bars, send their kids to good schools and roll through the streets in sleek sedans. Nairobi's upper crust has a decidedly nouveau riche feel to it.

But one expected dimension is still missing: art. Unlike the newly rich in cities like Dubai and even Moscow, who have poured a fortune into modern art collections as a way to convey status and style, wealthy Kenyans do not appear all that concerned yet. Music and fashion, sure. Theatre, even. But anything abstract splashed across a canvas still does not command much respect or revenue. Part of the problem is that art is not an examined part of school children's curriculum here. And partly because of history and demography, East Africa lags behind its neighbours in West and South Africa, where art markets have flowered and evolved and cultivated connections with Europe over time.

Some people say this is beginning to change: "These are shifting times," says James Muriuki, curator at the Ramoma modern art museum in Parklands. Nairobi appeared to have an art awakening in the 1970s and 80s, driven by passionate expat Ruth Shaffner and her Watoto Gallery. But that movement died with Shaffner, raising questions about how truly endemic the interest ever was. Over the past several years however, galleries like Ramoma and the artist's colony Kuona Trust have been working on a revival and nurturing a number of aspiring contemporary artists. This second generation has matured and begun making art that people with money are ever so slowly beginning to notice.

And now one of East Africa's largest corporate players is applying some of its financial and publicity power to the sector: Safaricom is about to launch a new modern art exhibition that will inhabit the ground floor of the new extension of Safaricom House – the "Safaricom Centre" – in Westlands. The exhibition will promote the work of 30 local artists to everyone who drops by.

The idea is that Safaricom does business with a lot of people, not to mention the hundreds of employees who work in these buildings. They will all get to see the art every day, along with new exhibits and performances as they rotate through the space in between company events. This art addresses critical things, like urban culture and politics – no lions or Masai warriors.

So Safaricom figures it will take some systematic exposure for people to warm up to it. When they do, the company hopes they will buy it.

"We're hoping this space will give different people a cost-effective platform to showcase their work," says Zaheeda Suleman-Arain, Safaricom's publicity manager who is overseeing the new centre.  The telecoms company is also hoping to instill an appreciation among the artists it works with for what it knows and does best: making money. "We want to see them take their art to the next level," says Wangari Muguru, Safaricom's head of marketing and communication, "to understand that you can't just be creative, you've got to live off it."

The telecoms company is also hoping to instill an appreciation among the artists it works with for what it knows and does best: making money. "We want to see them take their art to the next level," says Wangari Muguru, Safaricom's head of marketing and communication, "to understand that you can't just be creative, you've got to live off it."

This may be step one toward creating a real art market in a region where high-end appreciation has never been ingrained. In South Africa, many of the best private art collections are held by corporations, mirroring the trend in the industrialised world. Safaricom does not have any plans yet to establish a permanent collection, even though its current curator, Gonda Geets, is lobbying for this. But just the act of constructing an accessible space where art can be displayed for art's sake – not as meaningless decoration – grants the medium intrinsic value.

That value will hopefully translate into more local sales. Around 70% of Ramoma's current sales still come from expats and tourists. Piquing interest from Kenya's growing middle class would be a boon for the gallery. Muriuki also says East Africa is commanding more attention now from big-time curators and buyers in Europe. This is where the real money is. The shift dates back, he says, to the Africa Remix show put on by Simon Njami at London's Hayward Gallery in 2005. The mix featured work from across the continent, not just traditional stars from the west and south.

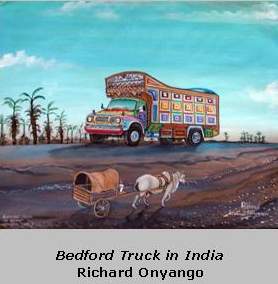

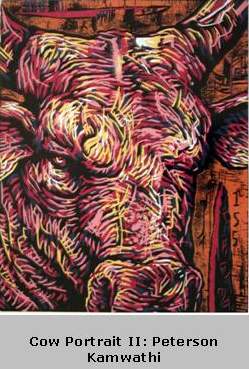

After spending 20 years in Kenya, artist and art dealer Ed Cross also recently moved back to London and took a stack of modern art with him. He now promotes work by edgy East African artists like Peterson Kamwathi, George Lilanga and Richard Onyango, whose fame and incomes are growing. Lilanga and Onyango have even found their way into the Pigozzi Collection, the largest private collection of contemporary African art in the world patched together by the Italian venture capitalist Jean Pigozzi and his French curator, André Magnin.

Tapping the European market has  been West Africa's secret to success for some time. But the region also has a much longer tradition of art making and loving, spawned by a less nomadic heritage and ties to France.

been West Africa's secret to success for some time. But the region also has a much longer tradition of art making and loving, spawned by a less nomadic heritage and ties to France.

It may be decades before East Africa catches up. Galleries here need to learn how to package and market their artists. They must also figure out how to support themselves. Ramoma is in the midst of a significant restructuring as it hunts for new funding and focus.

A solid history of sales will also need to build up to make pricing art and promoting its prospective appreciation easier. Support from leading corporations like Safaricom will play a big role here. Especially because the Kenyan government has an endless string of other priorities that come before investing in the arts.

Although Safaricom hesitates to say others will follow its lead, many professionals in the region do look up to the company. And at least a few others have their own fascinations to tend. The Commercial Bank of Africa (CBA) building in Nairobi is overflowing with contemporary African art thanks to the personal interest of the bank's managing director, Isaac Awuondo, also a board member at Kuona Trust. He has Jimnah Kimani's wild colours in the CBA lobby, Richard Kimathi abstracts in the board room, and more art at home than walls to put it on, literally: Awuondo is actually building a second home just to house his art collection, which at cost has hit KES5m and is likely worth many times that. Tony Wainaina, the energetic former TransCentury investment banker, is also on the board at Ramoma. The sleek new Sankara hotel in Westlands has hired curator Marc van Rampelburg to line its halls with East African pieces. And the Zeitz Foundation – the enviro-social vision of Puma head Jochen Zeitz – that recently launched in Kenya is rumored to be an arts supporter as well.

Awoundo sees the market growing slowly. "Ultimately, it has to be tied to economics," he says. "Twenty years ago, when I was spending KES100,000 on a piece of art, people thought I was mad." That is what Awoundo spent on each of the 10 large works he owns by Peter Elungat. Similar pieces by the artist that sold a few years ago went for KES750,000. So the potential is there, and gaining momentum. But art here is still difficult even to value: The market is so disjointed and underdeveloped that it will be many years before East African art joins its western peers as an attractive investment or status symbol.

Case in point: In 2004, Coca-Cola Africa hired Camille Wekesa, a Kenyan muralist who now sits on Ramoma's board, to curate a collection for its UK office. Wekesa meticulously compiled 180 pieces that included work from Elungat and some of her other favourite Kenyan artists.

Then, a few years ago, Coke moved its headquarters to South Africa. Rather than take the collection with it, the company sold most of it off as individual pieces to its employees. Wekesa just shakes her head in disbelief. "To buy that same art is going to cost them six to seven times today," she says. But even Coke, cosmopolitan company that it is, did not see the collection as an investment, a cultural entity exceeding in both social and economic value the sum of its parts. Wekesa says the art to them and too many others is still "just like paint on the wall".

This article was first published in Ratio Magazine – www.ratio-magazine.com