ReConnect Africa is a unique website and online magazine for the African professional in the Diaspora. Packed with

essential information about careers, business and jobs, ReConnect Africa keeps you connected to the best of Africa.

ReConnect Africa is a unique website and online magazine for the African professional in the Diaspora. Packed with

essential information about careers, business and jobs, ReConnect Africa keeps you connected to the best of Africa.

A recent investment forum in London highlighted the opportunities for trade and investment in Ghana

A recent investment forum in London highlighted the opportunities for trade and investment in Ghana

Ghana is the UK’s third largest export market in sub-Saharan Africa and a recent investment forum held in London saw the country’s President and a number of government ministers take to the stage to showcase business opportunities.

Participants at the event included representatives from the business and investment communities, diplomats and media. HE Victor Smith, Ghana’s High Commissioner to the UK, welcomed the delegates and highlighted Ghana’s longstanding relationship with the UK, which made more than £580 million through exports to Ghana in 2013 and is showing increasing interest in Ghana across a range of sectors.

Easy Doing Business

In the recently published ‘Ease of Doing Business’ rankings, Ghana was ranked number 1 in West Africa and number 5 in sub-Saharan Africa. In his address, the High Commissioner pointed out that there were over half a million Ghanaian diaspora in the UK and noted that in July 2013, Ghana entered into a high level partnership with the UK and four other countries to strengthen economic cooperation, agree more favourable trade conditions and to work in partnership and leverage expertise.

Matt Baugh, Head of East & West Africa at the FCO, spoke on behalf of the UK Government, saying: “There is a close bond between Ghana and the UK and deep links between our two countries” and that “Ghana remains a benchmark of Africa.”

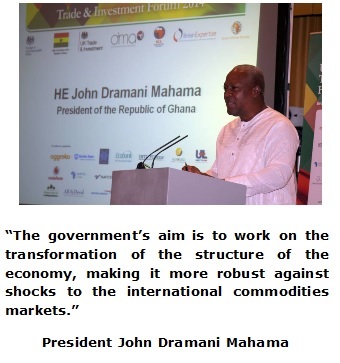

“The Africa Rising narrative which was prevalent only a few years ago has had to shift from the fairy tale to a more realistic outlook,” said HE John Dramani Mahama, President of the Republic of Ghana. The President pointed out that the narrative from 2012 to 2013 has changed things somewhat and noted the areas in which the country was struggling to stay ahead of the game.

Economic Challenges

From 2011-2012, said the President, Ghana suffered macroeconomic instability. Despite significant growth rates, the economy is still dependent on its primary exports of gold and cocoa and this dependency, he said, means that shifts in international commodity markets impact heavily on Ghana. Cocoa lost 40% of its value on the international markets and gold also took a hit. While cocoa prices have rebounded, gold is still sluggish.

“The country has also faced other domestic challenges, including implementing a new public wage policy which led to an increase on the public purse from US$3 billion to US$9 billion in a two year period. This created pressures on the budget and lead to major challenges”, the President added.

“The country has also faced other domestic challenges, including implementing a new public wage policy which led to an increase on the public purse from US$3 billion to US$9 billion in a two year period. This created pressures on the budget and lead to major challenges”, the President added.

President Mahama cited the depreciation of the currency as yet another challenge, with the cedi at one point sliding down by 27% against the dollar, Ghana’s major trading currency.

Outlining his government’s strategy to put the country back on track, he added: “The 2013 budget introduced measures to arrest this trend and leading to comprehensive solutions involving strong measures to hold down expenditure and increase revenues. Ghana’s negotiations with the IMF are ongoing and intended to hammer down the various elements of a 3 year programme.”

According to the President, Ghana’s economy remains robust despite all the factors highlighted, but it is important to keep a balanced budget. “We successfully launched a Eurobond which was oversubscribed and a cocoa bond which was also very successful.”

Transforming the Economic Structure

“The government’s aim is to work on the transformation of the structure of the economy and to provide more pillars to support it, making it more robust against shocks to the international commodities markets,” said President Mahama. “We have a fledgling oil and gas sector and Tullow Oil is one of the major investors in this sector. The Services sector has overtaken agriculture as a contributor to GDP, and we have seen increased investments into infrastructure, which is a challenge in Ghana.”

Clearly upbeat about his government’s plan, he added that “Where there’s a challenge, there’s an opportunity.”

He noted plans to expand the port of Takoradi to address the increasing amount of imports coming in to the country and acknowledged the country’s issues with securing sufficient power for its needs.

“There is an increasing demand for power – 12% between 2012 and 2014. As fast as we increase generation, the demand rises. We have a vision to expand power generation to 5000 megawatts in the next three years and this offers a huge opportunity for investing in Ghana’s power sector. With the processing of gas, we will see more revenues from this resource.”

The President emphasised that Ghana is open for business and that, as part of West Africa, it is working towards integrating regional economies, “a priority for me as the current chair of ECOWAS,” he added. “It is preferable to have a market of 350 million in West Africa rather than 24 million in Ghana alone, and so goods and services are able to move freely within our countries.”

The President emphasised that Ghana is open for business and that, as part of West Africa, it is working towards integrating regional economies, “a priority for me as the current chair of ECOWAS,” he added. “It is preferable to have a market of 350 million in West Africa rather than 24 million in Ghana alone, and so goods and services are able to move freely within our countries.”

The message of optimism about the economic direction of the country was echoed by Seth Terkper, Ghana’s Minister of Finance, who took to the stage after the President. “We are hopeful that Ghana will overcome its current challenges and we will see growth again. We are trying to evolve strategies for managing Ghana’s volatility in terms of the impact of international commodity prices. Ghana had been growing at 8% until its more recent challenges and negotiations with the IMF will provide back stopping for the recovery of the economy.”

The Minister spoke of some of the causes for the overheating of the economy, and cited the rebasing of the country’s GDP which led to an increase of 60% and put Ghana into lower middle-income status.

Oil and gas added to the volatility and created higher expectations, he said, while the reduction of subsidies, interest payment overruns and an increased public wage bill led to setbacks in revenues as a result of a shortfall in grants and corporate income from the petroleum sector which, he said, had been grossly overestimated.

A Home-Grown Strategy

Further challenges came with the decline of gold and cocoa prices and unstable output of gas from the West African pipeline. All this plus the depreciation of the cedi led to the need to go to the IMF.

All these challenges, the Finance Minister said, have led to the government putting in place a home-grown strategy. “Steps are being taken to clear the arrears and we are hopeful of moving into a ‘better fiscal space.”

Key to improving Ghana’s economic performance, said the Minister, is the need for diversification of the economy. Value addition is also important, for example with the production of power, while local content requirements are a critical element for stabilising the economy. Local content is increasingly becoming a requirement for investors, he said, and at the top of Ghana’s agenda. The Minister clarified that local content requires a certain percentage of ownership to be Ghanaian and that it is also about using Ghanaians for service delivery and implementation.

The Finance Minister stressed the need for Ghana to move from primary exports to exporting secondary goods: “The market is there, the labour is there,” he said.

The importance of the oil revenues to Ghana’s development was also a subject the Finance Minister addressed. “The Ghana Infrastructure Fund has been set up to leverage our oil revenues and to borrow for infrastructure development. Eventually it will be a rated entity that can leverage the capital markets and help to diversify the sources of revenue for the budget,” he explained.

The importance of the oil revenues to Ghana’s development was also a subject the Finance Minister addressed. “The Ghana Infrastructure Fund has been set up to leverage our oil revenues and to borrow for infrastructure development. Eventually it will be a rated entity that can leverage the capital markets and help to diversify the sources of revenue for the budget,” he explained.

The role of the private sector was also one that needed to be further developed, he said. “Private sector contributions are significant and it is important to note that not a single company that invested in oil and gas has come to government for financing. It has all come from direct investment, private equity, etc.”

Ghana’s financial services sector has developed considerably, he added. “Ghana has 27 banks, some of which are global financial institutions, as well as local banks that understand how to do business in Ghana, and The Bank of Ghana is a consultative regulator staffed with experienced people.”

Oil and Gas

Alex Mould of the Ghana Investment Promotion Council (GIPC) addressed the gathering and spoke about developments in Ghana’s oil and gas sector.

“Oil and gas are nascent or growing industry sectors,” he said. “2012 saw 7 new oil and gas discoveries and there have been 24 new discoveries since Jubilee, and therefore tremendous opportunities for development.”

10 oilfields are coming on-stream in mid-2015 and GNPC is mandated to increase the amounts of gas in the country requiring, he said, independent power producers. He reiterated the importance of the local content requirements in helping to develop the country’s human resources – 50% of Ghanaians are under the age of 25 - saying: “We are looking for good partners where their businesses work with the locals to develop them.”

Private sector businesses that took to the stage included Vodaphone, who praised the conditions for doing business in Ghana and cited benefits such as a free press, job creation, health education, rule of law, regulation, security and stability.